Jan 27, 2026

US Large NxtGen Index Report - January 2026

Weaker predictive strength and low beta orientation impact US Large NxtGen performance in 2025

Jan 15, 2026

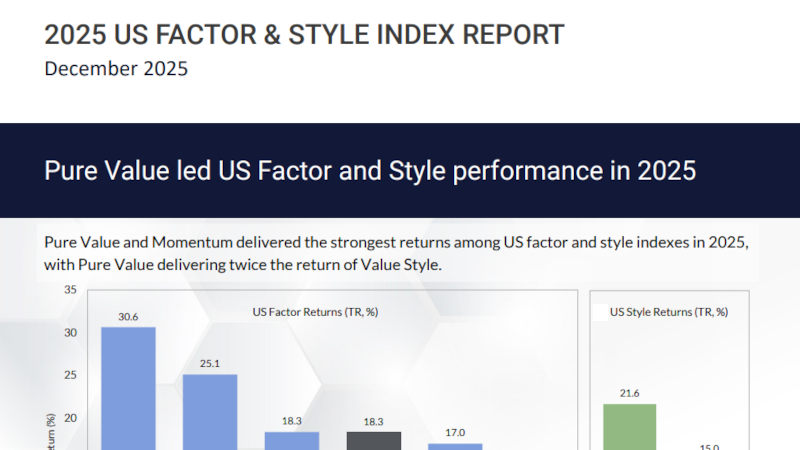

Factor & Style Index Report - Q4 2025

Quarterly Report covering US Pure Factor and Style Performance and attribution analysis - Q4 2025

Dec 9, 2025

Capturing Real Asset Exposure via an All-Equity Index

Is it possible to capture Real Asset characteristics via an all-equity index? The answer is yes.

Oct 9, 2025

Factor & Style Index Report - Q3 2025

Quarterly Report covering US Pure Factor and Style Performance and attribution analysis - Q3 2025

Sep 10, 2025

A deep dive into the exposures captured by the FT Wilshire Global Top 500 index

A detailed analysis of the FT Wilshire Global Top 500 index, from market capitalisation and industry exposure to stock level concentration, valuation and profitability metrics.

Jul 14, 2025

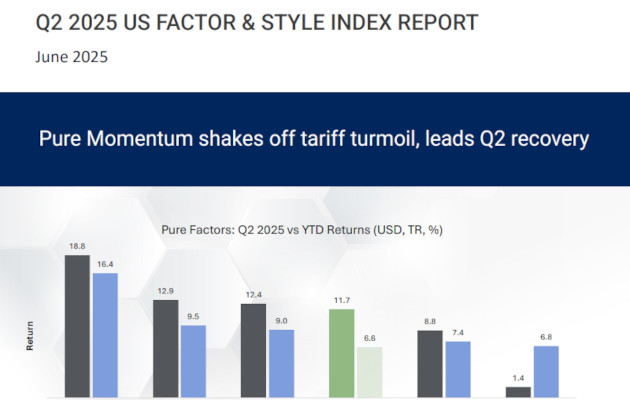

Factor & Style Index Report - Q2 2025

Quarterly Report covering US Pure Factor and Style Performance and attribution analysis - Q2 2025

Jul 10, 2025

The structural shift towards passive investing implementation is showing no signs of abating

The structural shift towards passive investing implementation is showing no signs of abating

Apr 15, 2025

Factor & Style Index Report - Q1 2025

Quarterly Report covering US Pure Factor and Style Performance and attribution analysis - Q1 2025

.png)

Feb 5, 2025

Leveraging Machine Learning in Portfolio Construction

AI and Machine Learning techniques are increasingly being used in finance.

Jan 20, 2025

Traditional Asset Allocation with Digital Assets

Adding Bitcoin to traditional portfolios can enhance risk-adjusted returns with allocations as low as 2%-7%, but risk concentration demands new management frameworks

Jan 14, 2025

Factor & Style Index Report - Q4 2024

Quarterly Report covering US Pure Factor and Style Performance and attribution analysis - Q4 2024

Dec 6, 2024

Macro regimes shifts and the evolution of multi-factor methodologies

Examining the impact of structural headwinds on factor return characteristics - 40+ years of change in market structure and economic regime backdrop, plus unintended factor exposures.

Oct 7, 2024

Factor & Style Index Report - Q3 2024

Quarterly Report covering US Pure Factor and Style Performance and attribution analysis - Q3 2024

Aug 30, 2024

Capping Infrastructure Indexes

As the growth in infrastructure accelerates globally, the importance investors place on sectors, countries, and regional exposure is emerging as a key theme in infrastructure allocations

Jul 10, 2024

Factor & Style Index Report - Q2 2024

Quarterly Report covering US Pure Factor and Style Performance and attribution analysis - Q2 2024

Apr 16, 2024

Avoid the Size Trap

We examine two distinct methods of size segmentation in the US market: a count-based approach (applying a rigid stock count such as 1000 and 2000 stocks) and an adaptive cumulative market approach based on percentage allocation.

Apr 10, 2024

Factor & Style Index Report - Q1 2024

Quarterly Report covering US Pure Factor and Style Performance and attribution analysis - Q1 2024

Jan 16, 2024

Factor & Style Index Report - 2023

Quarterly Report covering US Pure Factor and Style Performance and attribution analysis - 2023

Oct 11, 2023

Factor & Style Index Report - Q3 2023

Quarterly Report covering US Pure Factor and Style Performance and attribution analysis - Q3 2023.

Mar 28, 2023

Did traditional style indexes create a false narrative for factor analysis in 2022?

Was the rotation from Growth to Value in 2022 as significant as it seemed? Not if viewed through the prism of ‘Pure Factors’

Feb 6, 2023

Accessing Global Markets with precision: Introduction to the FT Wilshire Global Equity Market Series

A global equity index can serve as the benchmark for ETFs, index funds or structured products, and also supplies reference points for global asset allocation and rich information for measuring the global economy.

Aug 26, 2022

Capture Value and Growth Styles with precision

Value and Growth are important style segments that investors use to navigate the US market. The new FT Wilshire US

Growth and Value Index Series addresses the robustness and transparency issues of legacy indexes.