US economy facing growing stagflation risks vs reflation optimism in the Eurozone, most notably in Germany

Tariff uncertainty and a weaker dollar are creating inflationary noise for the Fed.

Growth has continued to outperform Value. Small cap has marginally outperformed large cap over three months but saw negative returns in January.

Growth sees a 5yr annualized return of 17.9% vs 10.7% for value.

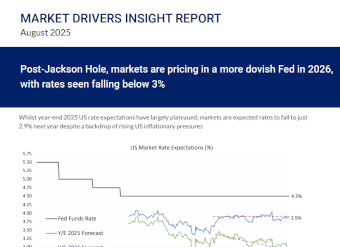

The US has seen the largest decline in2025 rate expectations since the start of the year.

There still remains a relatively wide differential between US and Eurozone rate expectations.

Within the US, the Mag 7 stocks have seen a significant de-rating so far this year.

European equities have seen a near 10%re-rating since the start of the year but are still well below post-Covid highs of 18.2x.

The US has seen 2025 EPS growth forecasts move lower so far this year, most notably amongst the Mag 7 stocks.

Whilst underlying US 2025 EPS estimates have drifted lower since the start of the year, estimates for Europe ex UK have moved higher since mid February.